Corporate Governance

Key Performance in 2024

Rated Excellent or 5-stars following corporate governance disclosure by the Thai Institute of Directors (IOD) for the 6th consecutive year

Received the CAC Change Agent Award 2024 from the Thai Institute of Directors Association for the 4th consecutive year

Encouraged suppliers to commit and become part of Thai Private Sector Collective Action Against Corruption (CAC). 13 suppliers, accounting for 29.55% of all suppliers, participated in the training

Certified ISO 27701 standard for Privacy Information Management System (extension of ISO/IEC 27001 Information Security Management System)

Awarded Advanced Level for Cyber Security Rating by BITSIGHT

Received a score of 3.52 by Cybersecurity Resilience Survey 2024, a score higher than the industry average

Key Progress in 2024

Corporate Governance Self-Assessment (CG Self-Assessment) for executives at the general manager level or equivalent and above

Joint expansion of the transparency network with suppliers and SMEs to commit and declare anti-corruption intentions and conduct operations with good governance throughout the supply chain

Training and providing knowledge regarding legal risk prevention measures for offices, 7-Eleven stores and subsidiaries, inclusive of trade partners (Store Business Partner)

Training, providing knowledge and organizing cyber vaccine testing for employees at all levels to create awareness of potential criminal activities and cyber safety

Adopt information security standards and personal information management systems (ISO 27001 and ISO 27701) and continuous implementation within CP ALL Public Company Limited and its subsidiaries

Data Protection Impact Assessment (DPIA) on all activities which process personal data

Organize training courses and knowledge assessment via E-learning system for employees at all levels on sustainable development, which includes aspects of the environment, human rights, good governance,

anti-corruption measures, personal data protection and cyber security risk management

Supporting the SDGs

SDG 12 Ensure sustainable consumption and production patterns

12.6 Encourage companies, especially large and transnational companies, to adopt sustainable practices and to integrate sustainability information into their reporting cycle

SDG 16 Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable, and inclusive institutions at all levels

16.3 Promote the rule of law at the national and international levels, and ensure equal access to justice for all

16.5 Substantially reduce corruption and bribery in all its forms

16.7 Ensure responsive, inclusive, participatory, and representative decision-making at all levels

Performance Against Goal

Results of the “Double Materiality Matrix”

Sustainability Dimensions

Impact level for application in business operations

Progress against Short-term and Long-Term Goals

The Company’s corporate governance rating by an internationally recognized institute

Performance Summary 2024

The Board of Directors’ Composition

Board of Directors

Males

Female

Average tenure is at

Executive Directors

Independent Directors

Non-executive Directors

Governance and Anti-Corruption Training and Assessment

Employees of CP ALL

Communicated

Written/Digital Acknowledgement

Training Provided

Employees of Subsidiaries

Communicated

Written/Digital Acknowledgement

Training Provided

Tier-1 Suppliers

Communicated

Written/Digital Acknowledgement

Training Provided

Create a culture of compliance with laws, regulations, and policies

Departments with legal and corruption risks have been assessed

Departments at risk have established risk management measures

Report on Fraud, Corruption, and Bribery Violations

Number of Confirmed Cases of Fraud, Corruption, and Bribery

Proportion of Operational Areas Affected by Fraud, Corruption, and Bribery Issues

Grievance regarding personal data violation investigated and confirmed

Customers’ data

Regulatory bodies

Regulatory bodies

Risks and Opportunities

Good corporate governance is a key mechanism in organizational drive towards achieving established goals and intentions for sustainable business operations. Key factors in operations include the Board of Directors, which play a role in overseeing and monitoring the organization’s operations, ensuring transparency, preventing corruption, and being mindful of ethics, morality, and human rights, as well as upholding sustainable development considerations. The effectiveness of the Board’s work depends on the independence of its members, as well as diversity in skills and backgrounds. Furthermore, developing capabilities to compete in business and instilling confidence in stakeholders throughout the value chain through corporate governance shall enhance the organization’s business operations, attract investor interest, and support long-term organizational success.

Additionally, continuous development of risk management systems to align with laws and regulations, and oversight by relevant departments, in addition to communication and fostering understanding among employees at all levels, enables proper implementation by employees. This approach can reduce risks associated with legal violations and human rights issues related to business operations.

Management Approach

The Company Sustainability and Corporate Governance Committee establishes, manages, and reviews corporate governance policies, sustainability policies, anti-corruption policies, as well as business ethics and codes of conduct, to ensure alignment with corporate governance principles according to regulatory agencies, laws, and international standards. In addition, the Company has organized training workshops and post-training assessments covering aspects involving the environment, human rights, good governance, anti-corruption, personal data protection risk management and cyber security. The focus of this approach includes promoting good conscience among employees at all levels, maintaining operations according to good governance principles, creating an organization which conducts business sustainably, transparently, and becoming an industry leader in sustainability and good corporate governance.

Furthermore, the Company conducts its business in accordance with legal regulations relevant to both domestic and international operations, adhering to the principles of business ethics and codes of conduct. These serve as guidelines for conducting operations and fulfilling responsibilities with honesty, integrity, adherence to legal principles, transparency, non-violation of human rights, noninvolvement in politics, no bribery or corruption, no conflict of interest, and no infringement of intellectual property or copyrights of others. Additionally, the Company continuously considers the interests of all stakeholders and demonstrates responsibility towards communities, society and the environment.

Good Governance Principles

1 Establish Clear Leadership Role and Responsibilities of the Board

2 Define Objective that Promote Sustainable Value Creation

3 Strengthen Board’s ffectiveness

4 Ensure Effective CEO and People Management

5 Nurture Innovation and Responsible Business

6 Strengthen Effective Risk Management and Internal Control

7 Ensure Disclosure and Financial Integrity

8 Ensure Engagement and Communication with Shareholders

ESG Issue That May Impaot Investment Performance

Corporate Governance Policy

Shareholders’ Rights

Equitable Treatments of Shareholders

Stakeholders’ Roles

Disclosure and Transparency

The Board’s Responsibility

Risk Management

Business Ethics and Code of Conduct

Anti-Corruption Policy

Prevention of conflicts of interest, internal data usage oversight, as well as internal control and auditing

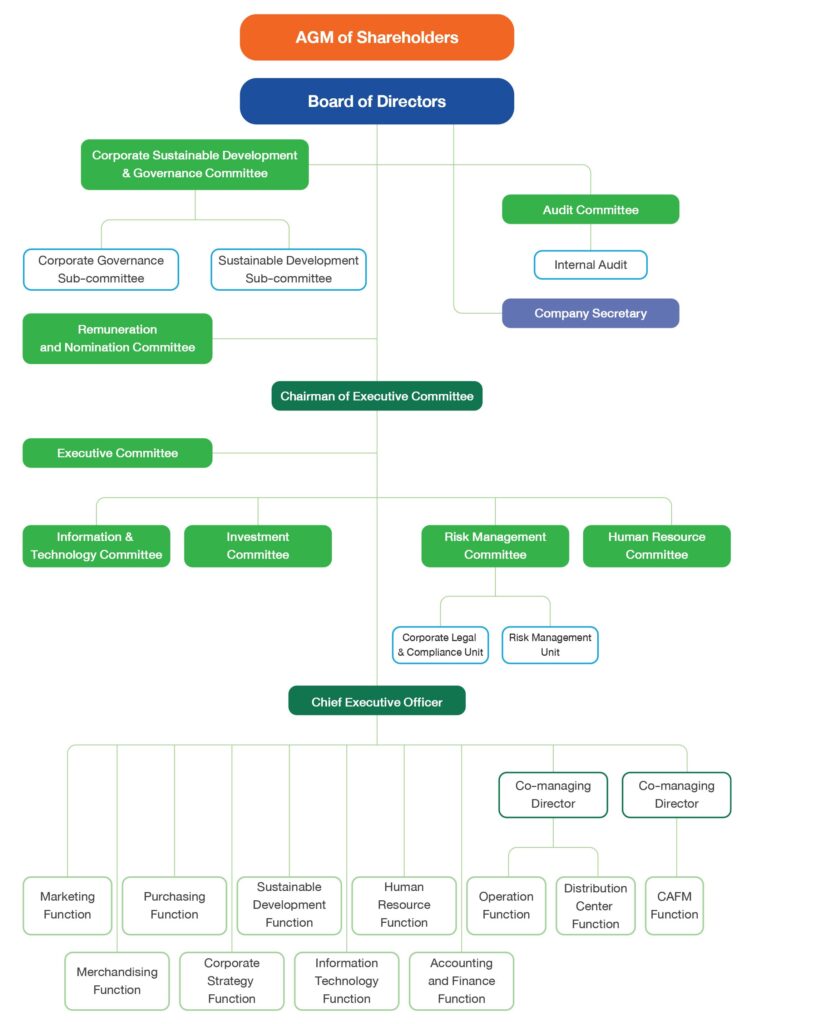

Governance Structure

Sub-committee

The Company has set up independent sub-committees operating and serving under the Board of Directors, whose crucial roles comprises:

| Audit Committee | Sustainability and Corporate Governance Committee | Remuneration and Nomination Committee |

|---|---|---|

|

|

|

Board of Director Structure

CP ALL Public Company Limited’s Board is comprised of 16 directors, of which 5 were executives, 6 were independent directors, and 5 were non-executive directors. Furthermore, the Company allocated authority by dividing the authority between the chairman and the chairman of executive committee (CEC) in a distinct manner, including the company has disclosed information according to their knowledge

and specific expertise to demonstrate proficiency, skills, and experience, as well as suitable qualifications for the position of director in accordance with the Global Industry Classification Standard (GICS). Other disclosed information includes Consumer Staples for the business to effectively operate in response to the Company’s strategy and goals as well as stakeholders.

Skills required for recruiting company directors

There is a diversity among the Board’s members in terms of qualifications, gender, age, educational background, and experience, without limiting other differences. Members possess skills aligned with the Company’s business strategy, as outlined in the Board Skill Matrix as follows:

The Board of Directors Skill matrix

| Name | Skill matrix | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Accounting & Finance | Economics & Banking | Administration & large organization management | Risk Management | Crisis Management | Business & Market | International Competition | Digital | Research & Development | Law & Case | Security & Society | |

| 1. Adj. Pro. Prasobsook Boondech | x | x | x | x | x | ||||||

| 2. Pol. Gen. Dumrongsak Kittiprapas | x | x | x | x | x | ||||||

| 3. Mr. Padoong Techasarintr | x | x | x | x | x | x | x | x | |||

| 4. Mrs. Nampung Wongsmith | x | x | x | x | |||||||

| 5.Mr. Somboon Ngamlak | x | x | x | x | x | x | x | ||||

| 6. Adj. Pro. Dr. Kittipong Kittiyarak | x | x | x | x | x | ||||||

| 7. Mr. Soopakij Chearavanont | x | x | x | x | x | x | x | x | |||

| 8. Mr. Korsak Chairasmisak | x | x | x | x | x | x | x | x | |||

| 9. Mr. Suphachai Chearavanont | x | x | x | x | x | x | x | x | |||

| 10. Mr. Tanin Buranamanit | x | x | x | x | x | x | |||||

| 11. Mr. Adirek Sripratak | x | x | x | x | x | x | x | ||||

| 12. Mr. Umroong Sanphasitvong | x | x | x | x | x | x | x | ||||

| 13. Mr. Narong Chearavanont | x | x | x | x | x | x | x | x | |||

| 14. Mr. Prasert Jarupanich | x | x | x | x | |||||||

| 15. Mr. Pittaya Jearavisitkul | x | x | x | x | x | x | |||||

| 16. Mr. Piyawat Titasattavorakul | x | x | x | x | x | x | |||||

- Administration and management of large organization include determining corporate visions and missions and human resource management

- Business and marketing include logistics and distribution

- Digital includes E-commerce, technology, information security & cyber security

- Law and litigation include business laws, securities laws, and tax laws

- Security and society include environment, community, and safety

- Economics and banking include financial and investment institutes

For more details of the Board industry experience in accordance with the GICS Level 1classification at —> Board Industry Experience

Essential skills for recruiting senior executives (CEO,CEO-1,CEO-2)

In order for the organization to compete in a highly competitive market and maintain its growth sustainably, the Company has policies and programs in place for successor and development as well as for succession planning for senior management positions To ensure that executives or leaders in important positions in the organization will have successors. The company has determined the necessary skills for senior executives as follows:

| 1. CPALL Leadership DNA | ||||

|---|---|---|---|---|

| Ability to think (able to think) | Communication ability (speaking) | Ability to act (achieve success) | Ability to work with others (understand people) | Ability to have a worldview (have a worldview) |

| 2. Leadership characteristics (faith)-11 Leadership | ||||

| Sincerity / Non-arrogance / Verbal Consciousness / Non-Power Abusive Good Role Modeling / Possessing Fairness / Merciful / Decisive Societal Care / Cultivating Good People / Open Mindedness |

||||

| 3. Professional knowledge (able) – Knowledge | ||||

| 4. Expertise experience (experience) | ||||

Senior Executive Recruitment Process (CEO, CEO-1 ,CEO-2)

The Company conducted the selection of successors from the talent pool and evaluated successors’ readiness using various tools, including psychological tools, 360-degree feedback, and assessments of their readiness for higher positions. The results were then used to create Individual Development Plans (IDPs) The Company will monitor and report the progress of the development to the Personnel Committee and top management regularly to ensure that those selected (Candidate Nomination) Be ready to inherit important positions in the organization

Other Information

Management Structure by the Company’s Board of Directors

1. Board of Directors

As of December 31, 2024, the Company’s Board of Directors consists of 16 members including: Executive Directors 5 persons; and Non-Executive Directors 11 persons, which are as follows: Independent Directors 6 persons (account for one-third of Board members) Non-executive Directors 5 persons (account for one-third of Board members)

Names of the Board of Directors

| Name List | Positions |

|---|---|

| 1. Adj. Pro. Prasobsook Boondech | Independent Director, Chairman of Sustainability and Corporate Governance Committee |

| 2. Pol. Gen. Dumrongsak Kittiprapas2 | Independent Director, Chairman of Remuneration and Nomination Committee, Sustainability and Corporate Governance Committee |

| 3. Mr. Padoong Techasarintr | Independent Director, Chairman of Audit Committee, Sustainability and Corporate Governance Committee, Remuneration and Nomination Committee |

| 4. Mrs. Nampung Wongsmith | Independent Director and Audit Committee |

| 5. Mr. Somboon Ngamlak | Independent Director and Audit Committee |

| 6. Adj. Pro. Dr. Kittipong Kittiyarak | Independent Director |

| 7. Mr. Soopakij Chearavanont | Chairman |

| 8. Mr. Korsak Chairasmisak1 | Vice Chairman and Chairman of Executive Committee |

| 9. Mr. Suphachai Chearavanont1 | Vice Chairman and Remuneration and Nomination Committee |

| 10. Mr. Tanin Buranamanit1 | Vice Chairman and Vice Chairman of Executive Committee |

| 11. Mr. Adirek Sripratak1 | Director |

| 112 Mr. Umroong Sanphasitvong1 | Director, Member of Executive Committee, Sustainability and Corporate Governance Committee |

| 13. Mr. Narong Chearavanont1 | Director |

| 14. Mr. Prasert Jarupanich1 | Director |

| 15. Mr. Pittaya Jearavisitkul1 | Director and Vice Chairman of Executive Committee |

| 16. Mr. Piyawat Titasattavorakul1 | Director and Vice Chairman of Executive Committee |

- Directors No. 8 – 16 are Authorized Directors.Director No. 4 Mr. Somboon Ngamlak was appointed as an Independent Director and Audit Committee on September 1, 2024 to replace Mr. Pridi Boonyoung, Independent Director and Audit Committee who resigned from directorship on the same dateDirectors No. 8 – 16 are Authorized Directors.

- Directors No. 8 – 16 are Authorized Directors. Authorized directors from Group 1 sign together with authorized directors from Group 2, two authorized directors jointly sign and affix the Company’s seal to bind the Company. This excludes the chairman and independent directors to maintain their independence, as per good corporate governance principles

Definition

The Company’s Board plays an important role in driving the organization, entrusted with the responsibility to ensure our corporate governance approach facilitates the Company towards the objectives and the goals of creating the highest value. Good corporate governance is built on the foundation of social and environmental responsibility, equal treatments to stakeholders—guided by the Corporate Governance and Anti-Corruption Policies. The Company’s corporate governance approach, defector, complies with relevant legal requirements, corporate goals and regulations, the Board’s charters, guidelines, and resolutions, as well as Shareholders’ resolutions. More info of the Board of Directors

2. The Board of Directors Positions in Sub-Committees

There are 3 Sub-Committees under the Company’s Board of Directors – the Audit Committee, the Sustainability and Corporate Governance Committee and the Remuneration and Nomination Committee. The committees under the Chairman of the Executive Committee are the Executive Committee and the Risk Committee.

Audit Committee

The Company’s Audit Committee is appointed by the Board of Directors and consist of at least 3 directors; whereby all are required to be Independent Directors who are not the Executives of the Company. The Manager of the Internal Audit Office shall act as the Secretary of the Audit Committee.

| 1. Mr. Padoong Techasarintr* | Chairman, Audit Committee |

| 2. Mr. Somboon Ngamlak** | Member, Audit Committee |

| 3. Mrs. Nampung Wongsmith | Member, Audit Committee |

* Member of the Audit Committee possessing the relevant knowledge and experience in finance and accounting, and able to review the credibility of the Financial Statements

** Mr. Somboon Ngamlak was appointed as an Audit Committee on September 1, 2024 to replace Mr. Pridi Boonyoung, who resigned from directorship on the same date

Sustainability and Corporate Governance Committee

The Sustainability and Corporate Governance Committee is appointed by the Board of Directors’ Meeting and is comprised of at least 3 directors, with at least half being Independent Directors and with Mr. Supot Shitgasornpongse, the Company Secretary, acting as the Secretary of the Committee.

| 1. Adj Pro Prasobsook Boondech* | Chairman, Sustainability and Corporate Governance Committee |

| 2. Pol. Gen. Dumrongsak Kittiprapas* | Member, Sustainability and Corporate Governance Committee** |

| 3. Mr. Padoong Techasarintr* | Member, Sustainability and Corporate Governance Committee |

| 4. Mr. Umroong Sanphasitvong | Member, Sustainability and Corporate Governance Committee |

* Independent Director

Remuneration and Nomination Committee

The Remuneration and Nomination Committee is appointed by the Board of Directors and is comprised of 3 persons, with at least half must be Independent Directors, with Ms. Lawan Tienghongsakul, Senior Vice President – Human Resource acting as Secretary to the Committee.

| 1. Pol. Gen. Dumrongsak Kittiprapas* | Chairman, Remuneration and Nomination Committee** |

| 2. Mr. Padoong Techasarintr* | Member, Remuneration and Nomination Committee |

| 3. Mr. Suphachai Chearavanont | Member, Remuneration and Nomination Committee |

* Independent Director

3. Summary of the Performance of the Committees for Last Year

Board of Directors’ Meeting

Names of the Board of Directors and Board Members Attendance for the Year 2024

| Name List | Positions | Board of Directors (8 times) |

NonExecutive Directors Meeting (1 time) |

Shareholders’ Annual General Meeting (1 time) |

|---|---|---|---|---|

| 1. Adj.Pro.Prasobsook Boondech | Independent Director | 8/8 | 1/1 | 1/1 |

| 2. Pol.Gen. Dumrongsak Kittiprapas | Independent Director | 8/8 | 1/1 | 1/1 |

| 3. Mr. Padoong Techasarintr | Independent Director | 8/8 | 1/1 | 1/1 |

| 4. Mr. Pridi Boonyoung** | Independent Director | 6/6 | – | 1/1 |

| 4. Mr. Somboon Ngamlak*** | 1/1 | 1/1 | – | |

| 5. Mrs. Nampung Wongsmith | Independent Director | 8/8 | 1/1 | 1/1 |

| 6. Adj.Pro.Dr. Kittipong Kittayarak | Independent Director | 8/8 | 1/1 | 1/1 |

| 7. . Mr. Soopakij Chearavanont | Chairman | 7/8 | 1/1 | 0/1 |

| 8. Mr. Korsak Chairasmisak* | Vice Chairman | 7/8 | – | 1/1 |

| 9. Mr. Suphachai Chearavanont | Vice Chairman | 8/8 | 1/1 | 1/1 |

| 10. Mr. Tanin Buranamanit | Vice Chairman | 8/8 | – | 1/1 |

| 11. Mr. Adirek Sripratak | Director | 8/8 | 1/1 | 1/1 |

| 12. Mr. Umroong Sanphasitvong | Director | 8/8 | – | 1/1 |

| 13. Mr. Narong Chearavanont | Director | 8/8 | 1/1 | 1/1 |

| 14. Mr. Prasert Jarupanich | Director | 8/8 | 1/1 | 1/1 |

| 15. Mr. Pittaya Jearavisitkul* | Director | 8/8 | – | 1/1 |

| 16. Mr. Piyawat Titasattavorakul* | Director | 8/8 | – | 1/1 |

* Executive Director

** Mr. Pridi Boonyoung resigned on August 15, 2024 with an effective date on September 1, 2024

** Mr. Somboon Ngamlak was appointed as an Independent Director on September 1, 2024

Assessment of the Performance of the Board of Directors

The Company has established an evaluation process of the performance of the Board of Directors of the Company and all sub-committees on an annual basis at least once a year. This is to enable the Directors of the Company to review and consider their respective performance outputs and achievements together with the various associated issues or obstacles in discharging their duties during the year, which will then enable them to improve their effectiveness as the Board of Directors through having a clearer understanding of their individual responsibilities, as well as to enhance the working relationships between the Board of Directors and the Management. The performance evaluation of the Board of Directors is divided into 2 types, that is, assessment of the overall performance of the Board of Directors as a whole and self-assessment of the performance of the individual director.

Remuneration of Individual Director

The Remuneration and Nomination Committee considers payment criteria and forms of director compensation before presenting to the Board of Directors and the shareholders’ meeting for approval every year. The remuneration of directors is adjusted to be comparable to other companies in the same industry and appealing enough to attract and retain quality directors.

(1) Cash Remuneration

The 2024 Annual General Meeting of Shareholders dated 26 April 2024 approved the remuneration for directors at the same rate as approved in the Annual General Meeting of Shareholders Year 2023 dated April 21, 2023, which is also the same rate as approved in the Annual General Meeting of Shareholders Year 2016 dated April 21, 2016 as follows:

| 1. Independent Director who is the Chairman of the sub-committee | 120,000 Baht/person |

| 2. Independent Director who is the member of the sub-committee | 100,000 Baht/person |

| 3. Independent Director who is not a member of the sub-committee | 80,000 Baht/person |

| 4. Chairman | 120,000 Baht/person |

| 5. Vice Chairman | 100,000 Baht/person |

| 6. Director | 60,000 Baht/person |

The Independent Director who is the member of several sub-committees shall receive only the highest rate of only one sub-committee. In addition, the shareholders’ meeting approved the bonus for directors at the rate of 0.50% of the dividend paid to the shareholders. The Chairman of the Board will allocate the appropriate amount of bonus to each director.

Remuneration for Directors from 1 January to 31 December 2024 (Unit : Million Baht)

| Name and Surname | Positions | Remuneration | Bonus | Total |

|---|---|---|---|---|

| 1. Adj. Pro. Prasobsook Boondech | Chairman of Sustainability and Corporate Governance Committee, and Independent Director | 1,440,000 | 3,858,000 | 5,298,000 |

| 2. Pol. Gen. Phatcharavat Wongsuwan* | Chairman of Remuneration and Nomination Committee, Sustainability and Corporate Governance Committee, and Independent Director | – | 2,572,000 | 2,572,000 |

| 2. Pol. Gen. Dumrongsak Kittiprapas* | 1,440,000 | 3,858,000 | 5,298,000 | |

| 3. Mr. Padoong Techasarintr | Chairman of Audit Committee, Sustainability and Corporate Governance Committee, Remuneration and Nomination Committee, and Independent Director | 1,440,000 | 3,858,000 | 5,298,000 |

| 4. Mr. Pridi Boonyoung** | Audit Committee and Independent Director | 1,000,000 | 3,215,000 | 4,215,000 |

| 4. Mr. Somboon Ngamlak** | 200,000 | – | 200,000 | |

| 5. Mrs. Nampung Wongsmith | Audit Committee and Independent Director | 1,200,000 | 3,215,000 | 4,415,000 |

| 6. Adj. Pro. Dr. Kittipong Kittayarak | Independent Director | 960,000 | 2,572,000 | 3,532,000 |

| 7. Mr. Soopakij Chearavanont | Chairman | 1,440,000 | 3,858,000 | 5,298,000 |

| 8. Mr. Korsak Chairasmisak | Vice Chairman | 1,200,000 | 3,215,000 | 3,572,000 |

| 9. Mr. Suphachai Chearavanont | Vice Chairman, and Remuneration and Nomination Committee | 1,200,000 | 3,215,000 | 3,572,000 |

| 10. Mr. Tanin Buranamanit | Vice Chairman | 1,200,000 | 3,215,000 | 3,572,000 |

| 11. Mr. Adirek Sripratak | Director | 720,000 | 1,929,000 | 2,649,000 |

| 12. Mr. Umroong Sanphasitvong | Director, and Sustainability and Corporate Governance Committee | 720,000 | 1,929,000 | 2,649,000 |

| 13. Mr. Narong Chearavanont | Director | 720,000 | 1,929,000 | 2,649,000 |

| 14. Mr. Prasert Jarupanich | Director | 720,000 | 1,929,000 | 2,649,000 |

| 15. Mr. Pittaya Jearavisitkul | Director | 720,000 | 1,929,000 | 2,649,000 |

| 16. Mr. Piyawat Titasattavorakul | Director | 720,000 | 1,929,000 | 2,649,000 |

| Total | 17,040,000 | 44,914,000 | 61,954,000 | |

* Pol.Gen. Dumrongsak Kittiprapas has been an Independent Director since November 10, 2023 to replace Pol. Gen. Pacharawat Wongsuwan, who resigned on August 10, 2023

** Mr. Somboon Ngamlak has been an Independent Director since September 1, 2024 to replace Mr. Pridi Boonyoung, who resigned on the same date

In addition, the Company’s Audit Committee received the remuneration of Baht 38,000 from the Company’s subsidiary (i.e., Panyapiwat Institute of Management) for being their Audit Committee in 2024.

Remuneration for Directors of Subsidiaries’ Company (CP Axtra Public Co., Ltd.) from January 1 to December 31, 2024 (Unit : Million Baht)

| Name and Surname | Positions | Remuneration | Bonus | Total |

|---|---|---|---|---|

| 1. Mr. Supachai Chearavanont | Chairman / Chairman of the Executive Committee | 1,860,000 | 2,790,000 | 4,650,000 |

| 2. Adj. Pro. Prasobsook Boondech | Independent director / Chairman of the Nomination and Remuneration Committee | 1,380,000 | 2,070,000 | 3,450,000 |

| 3. Mr. Korsak Chairasmisak | Director/ First Vice Chairman/ Member of the Nomination and Remuneration Committee | 1,260,000 | 1,890,200 | 3,150,000 |

| 4. Mr. Tanin Buranamanit | Director / Third Vice Chairman / Vice Chairman of the Executive Committee / Group Chief Executive Officer / Group Chief Retail Business Officer | 1,200,000 | 1,800,200 | 3,00,200 |

| 5. Mr. Umroong Sanphasitvong | Director / Member of the Corporate Governance and Sustainable Development Committee / Member of the Executive Committee | 1,260,000 | 1,890,200 | 3,150,000 |

| 6. . Mr. Adirek Sripratak | Director | 1,200,000 | 1,800,200 | 3,00,200 |

| 7. Mr. Narong Chearavanont | Director / Second Vice Chairman / Vice Chairman of the Executive Committeeร | 1,200,000 | 1,800,200 | 3,00,200 |

| 8. Mr. Prasert Jarupanich | Director | 1,200,000 | 1,800,200 | 3,00,200 |

| 9. Mr. Pittaya Jearavisitkul | Director / Member of the Executive Committee | 1,200,000 | 1,800,200 | 3,00,200 |

| 10. Mr. Piyawat Titasattavorakul | Director / Member of the Executive Committee | 1,200,000 | 1,800,200 | 3,00,200 |

| Total | 12,960,000 | 19,441,900 | 32,401,900 | |

(2) Other Remuneration

The Company has USD 40 million of the Directors’ and Officer’s Liabilities Insurance, which the premium is approximately Baht 3.2 million per year.

Remuneration for High-level Executives

High-level Executives’ Remuneration Policy and Criteria

The Board of Directors determines the policy on high-level executives’ remuneration to be at an appropriate level, fair, and in line with their responsibility in order to meet the expectations of various stakeholder groups and comply with related laws and regulations. The Remuneration and Nomination Committee has hired an independent expert to gather information and provide advice on establishing an appropriate compensation criteria and structure for high-level executives in order to present recommendations to the Board of Directors for approval. The following factors were taken into consideration:

In 2018, the Board of Directors considered and approved the criteria and indicators for compensating high-level executives in the form of special bonus in addition to the current bonus in order to motivate and drive executives to achieve new goals. This will be considered from achievement of 3 goals, which are, Return of Equity (ROE), customer satisfaction, and the Dow Jones Sustainability Index (DJSI) scores, which evaluate the effectiveness of business operations in accordance with the Company’s sustainable development.

Performance and key performance indicators of CEO and executives

Performance related to key performance indicators (KPIs) in the short term covers the following indicators:

Performance aimed at building the company’s long-term performance and management capabilities and leadership capabilities that will affect the company’s long-term sustainability.

The success of these KPIs reflects returns for the Chief Executive Officer and management. There is a transparent and reasonable process for determining compensation. compensation consists of salaries, bonuses, and special pension.

The Company evaluates the performance of chief executive officers, executives, and employees annually using the Core Performance Indicators of the Organization (KPI). Performance is evaluated based on : Metrics which supports corporate KPIs and special assignments (70%) and core behaviors (30%) which is evaluated according to the behavior of Harmony & CP six core values.

CORPORATE KEY PERFORMANCE INDICATORS (KPIs)

| Perspective | Corporate Key Performance Indicators 2023 |

|---|---|

| Financial Perspective (Revenue & Profit) |

|

| Customer Perspective (Customer base & Engagement) |

|

| Internal Process Perspective (Organization Efficiency) |

|

| Sustainability Perspective (Stakeholders’ Trust) |

|

Remuneration for Executive Committee and Executive Officers (High-level Executives)

(1) Cash Remuneration

| Year | Description | No. of Executives (Person) | Remuneration (Million Baht) |

|---|---|---|---|

| 2024 | Salary bonus and special penson | 13 | 561.393 |

| 2023 | Salary bonus and special penson | 14 | 484.366 |

| 2022 | Salary bonus and special penson | 17 | 474.950 |

| 2021 | Salary bonus and special penson | 18 | 429.425 |

| 2020 | Salary bonus and special penson | 16 | 403.098 |

| 2019 | Salary bonus and special penson | 17 | 561.393 |

| 2024 Total company accumulated cash remuneration | 39,750 million Baht |

| Payment for Executive Committee and Executive Officers | 1.32% |

(2) Other Remuneration

Remark : The Company suspended the 3rd Employee Joint Investment Program (EJIP) from the end of May 2020 to its ending period to relieve the burden of employees who voluntarily joined the program due to the COVID-19 situation.

Related Policy and Guideline

| Corporate Governance Policy | Download |

| Corporate Governance Guidelines for the Board of Directors | Download |

| Charter of the Board of Directors | Download |

| Audit Committee Charter | Download |

| Remuneration and Nomination Committee Charter | Download |

| Sustainability and Corporate Governance Committee Charter | Download |

| Corporate Legal Compliance Guideline | Download |

| Guidelines to Trade Competition Policy | Download |

| Conflict of Interest Policy and Guidelines | Download |